Forex trading, also called foreign trade trading or currency trading, could be the world wide market place for buying and selling currencies. It operates 24 hours a day, five times a week, allowing traders to participate available in the market from everywhere in the world. The principal purpose of forex trading is to benefit from fluctuations in currency change costs by speculating on whether a currency set may rise or fall in value. Individuals in the forex industry contain banks, economic institutions, corporations, governments, and personal traders.

One of many essential options that come with forex trading is their high liquidity, and therefore big volumes of currency can be purchased and distributed without considerably affecting trade rates. That liquidity assures that traders may enter and leave roles easily, enabling them to take advantage of even little cost movements. Furthermore, the forex industry is very accessible, with low barriers to access, allowing individuals to begin trading with fairly little levels of capital.

Forex trading provides a wide variety of currency couples to trade, including significant sets such as for example EUR/USD, GBP/USD, and USD/JPY, in addition to minor and incredible pairs. Each currency pair represents the trade rate between two currencies, with the initial currency in the pair being the beds base currency and the second currency being the estimate currency. Traders may make money from both climbing and falling markets by taking long (buy) or short (sell) positions on currency pairs.

Effective forex trading needs a strong comprehension of essential and technical analysis. Simple examination requires considering financial signs, such as curiosity costs, inflation costs, and GDP growth, to measure the main energy of a country’s economy and its currency. Technical evaluation, on another hand, requires examining price charts and styles to identify developments and potential trading opportunities.

Chance management can be necessary in forex trading to guard against possible losses. Traders usually use stop-loss orders to limit their drawback chance and use correct place sizing to make sure that not one deal may somewhat affect their over all trading capital. Also, sustaining a disciplined trading strategy and managing thoughts such as for example greed and concern are vital for long-term achievement in forex trading.

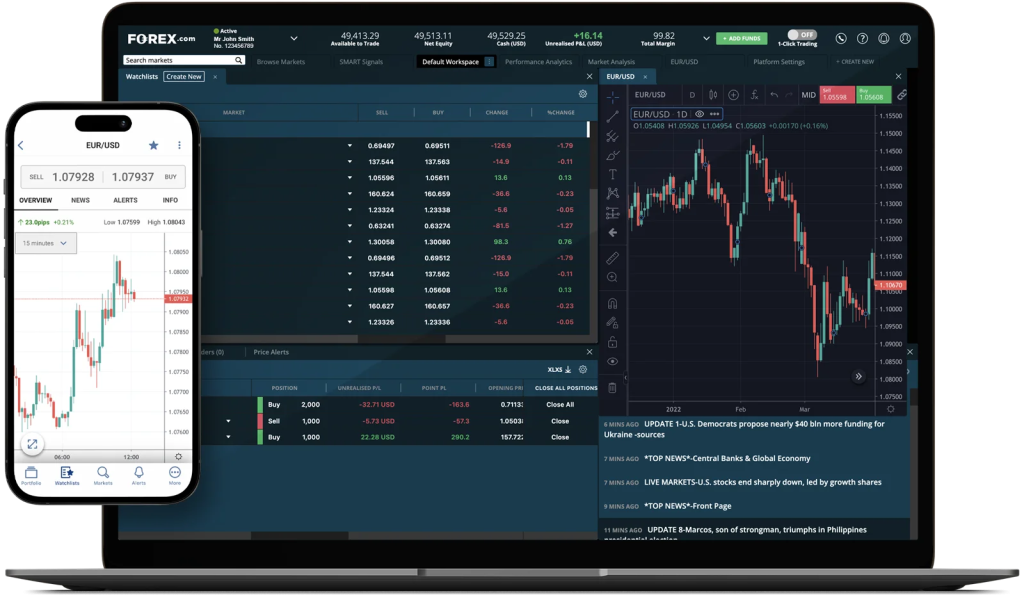

With the development of technology, forex trading has be more available than ever before. On line trading systems and portable apps provide traders with real-time access to the forex industry, letting them perform trades, analyze market knowledge, and manage their portfolios from any device. Moreover, the availability of educational forex robot sources, including courses, webinars, and demonstration records, empowers traders to produce their skills and enhance their trading performance over time.

While forex trading presents substantial profit possible, additionally it carries inherent dangers, such as the prospect of substantial losses. Thus, it is needed for traders to perform thorough study, develop a noise trading technique, and continuously check market situations to create educated trading decisions. By staying with disciplined risk management techniques and remaining informed about global financial developments, traders can improve their likelihood of success in the powerful and ever-evolving forex market.